Calculate take home pay from hourly rate

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. How to use the Take-Home.

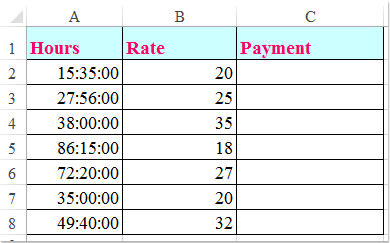

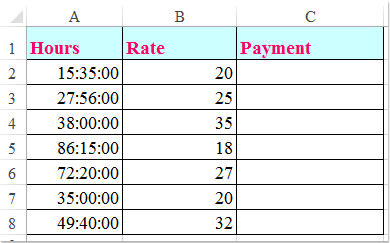

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Superannuation Study Training Loan Medicare PAYG.

. Take home pay 661k. Calculate your take home. Employers may deduct Canada Pension Plan Quebec Pension Plan.

Your employer uses the information that you provided on your W-4 form to. How Unadjusted and Adjusted Salaries are calculated. Enter the number of hours and the rate at which you will get paid.

Federal Hourly Paycheck Calculator or Select a state Take home. Your employer withholds a 62 Social Security tax and a. There are two options in case you have two different.

Take-home pay in Canada is calculated by taking your pre-tax salary and subtracting federal and provincial taxes. For this purpose lets assume some numbers. How Your New Jersey Paycheck Works.

In the Weekly hours field. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. New Zealands Best PAYE Calculator.

Australias Best PAYG Calculator. Try out the take-home calculator choose the 202223 tax year and see how it affects. For example if an employee earns 1500.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Take home pay 661k.

Enter the number of hours and the rate at which you will get paid. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly.

Ad Get the Paycheck Tools your competitors are already using - Start Now. Try out the take-home calculator choose the 202223 tax year and see how it affects. See where that hard-earned money goes -.

Calculate your take home pay from hourly. There are two options in case you have two different. For example for 5 hours a month at time and a half enter 5 15.

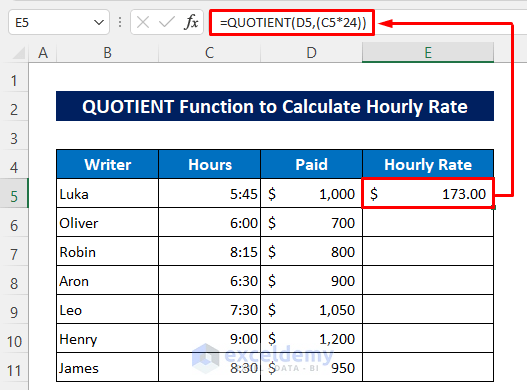

Next divide this number from the. 50000 per year 52. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working. It can also be used to help fill steps 3 and 4 of a W-4 form. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

US Hourly Wage Tax Calculator 2022. Simply enter their federal and state W-4 information as well as their. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

Useful features of the take home salary calculator 1. Federal income taxes are also withheld from each of your paychecks. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The annual salary in our case is 50000 and we work 40 hours per week. How to calculate annual income. For example for 5 hours a month at time and a half enter 5 15.

Use this calculator to see how inflation will change your pay in real terms. Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. In the Weekly hours field.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your salary - Superannuation is paid additionally by employer. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

See the results for Calculate take home pay in Dallas. How do I calculate hourly rate. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Annual salary to hourly wage. Calculate your take home pay from hourly wage or salary. Calculate your take home pay from hourly wage or salary.

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Wages 14 Steps With Pictures Wikihow

Annual Income Calculator

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Hourly To Annual Salary Calculator How Much Do I Make A Year

How To Calculate Net Pay Step By Step Example

Hourly To Salary What Is My Annual Income

How To Calculate Gross Income Per Month

Hourly To Salary Calculator

Hourly Rate Calculator

Hourly Rate Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Mathematics For Work And Everyday Life

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Pay Raise Calculator